Palm Beach County Roof Repairs: Comprehensive Insurance Insights for Homeowners

Roof damage in Palm Beach County can derail your budget and peace of mind, with thousands of homeowners filing claims after severe storms each year. This guide delivers clear insurance coverage explanations, step-by-step claim filing instructions, denial solutions, contractor selection tips, local regulatory requirements, timeline expectations, payout-maximization strategies, and market trends. By understanding perils covered, Florida’s roof rules, adjuster roles, appeals processes, and local resources, you’ll navigate insurance claims confidently and secure quality repairs without unexpected costs.

Roof Insurance Insights for Palm Beach Homeowners from Dream Team R

Homeowners insurance in Florida defines covered roof perils as sudden, accidental events that damage roofing materials and interior components. Understanding coverage ensures you claim wind, hail, fire, or lightning damage promptly and avoid gaps in protection.

Which Common Roof Damages Does Florida Homeowners Insurance Typically Cover?

Typically covered perils include:

- Windstorms and hurricanes causing shingle loss or structural failure.

- Hail strikes that dent metal flashing or fracture tiles.

- Fire or lightning that burns roofing materials and underlayment.

- Vandalism or falling objects such as tree limbs.

Coverage excludes normal wear, maintenance issues, or damage from insects and mold. Recognizing covered perils helps you report qualifying events and focus on official documentation for faster claim approval.

How Do Actual Cash Value (ACV) and Replacement Cost Value (RCV) Affect Your Roof Claim?

Actual Cash Value defines coverage as replacement cost minus depreciation, while Replacement Cost Value covers full material and labor expenses without depreciation.

Understanding the nuances of ACV and RCV is crucial for maximizing your claim settlement.

Calculating Roof Replacement Cost Versus Actual Cash Value in Insurance Claims

… seeks replacement of the entire roof to create a matching roof … with the ‘lower of cost or to replace Actual Cash Value.’ … Generally accepted accounting principles the replacement cost option …Calculating Actual Cash and Replacement Cost Values, Unknown Author, 2017

| Coverage Type | Definition | Impact on Settlement |

|---|---|---|

| Actual Cash Value | Replacement cost less depreciation | Lowers payout for older roofing materials |

| Replacement Cost Value | Full cost to repair or replace roofing | Maximizes payout for new shingles and labor |

Choosing a policy with RCV prevents reimbursement shortfalls and ensures you receive funds to install like-for-like materials, avoiding out-of-pocket expenses.

What Are Roof Repair Deductibles and How Do They Work in Florida Policies?

A deductible is the homeowner’s share of repair costs before insurance pays. Florida policies may include:

- Standard deductible: Fixed amount per claim (e.g., $1,000).

- Percentage deductible: Based on Dwelling Coverage limit (1–2% for hurricane events).

- Separate roof deductible: Up to 2% of Coverage A or 50% of roof replacement cost.

Selecting a lower deductible increases premiums but reduces upfront expenses after damage, while a higher deductible lowers premium costs but raises out-of-pocket risk when filing.

How Do Florida’s 15-Year Roof Rule and 25 Percent Rule Impact Insurance Coverage?

Florida law imposes two key regulations on roof claims:

- 15-Year Rule: Insurers must inspect roofs 15 years or older to confirm at least five remaining years of useful life before issuing or renewing coverage.

- 25% Rule: Coverage limits major repairs, allowing insurers to pay only 25% of total coverage for one loss if roof age exceeds 10 years.

Understanding Florida’s specific roofing regulations is essential for compliance and claim eligibility.

Florida Roof Repair Compliance with Insurance Regulations

… rule, now requiring only the repaired or replaced portion of the roof to comply with current Florida…Navigating the Uncertainties: Robust Reserving Strategies for Catastrophic Events, Unknown Author, 2024

Complying with these rules means homeowners maintain regular roof inspections and budget for potential inspection fees or partial payouts when filing claims for aging roofs.

How Do You File a Roof Insurance Claim in Palm Beach County? Step-by-Step Guide

Filing a roof claim promptly and accurately accelerates approval and repair scheduling. Follow a structured process to document damage, communicate effectively, and meet statutory deadlines.

What Are the Initial Steps After Experiencing Roof Damage?

Start your claim by:

- Ensuring safety by clearing debris and avoiding unstable areas.

- Contacting your insurance agent within 1–3 days of loss notification.

- Mitigating further damage through temporary tarping or boarding.

Promptly notifying your insurer and preventing additional damage safeguards your claim’s validity and positions you for a swift adjuster inspection.

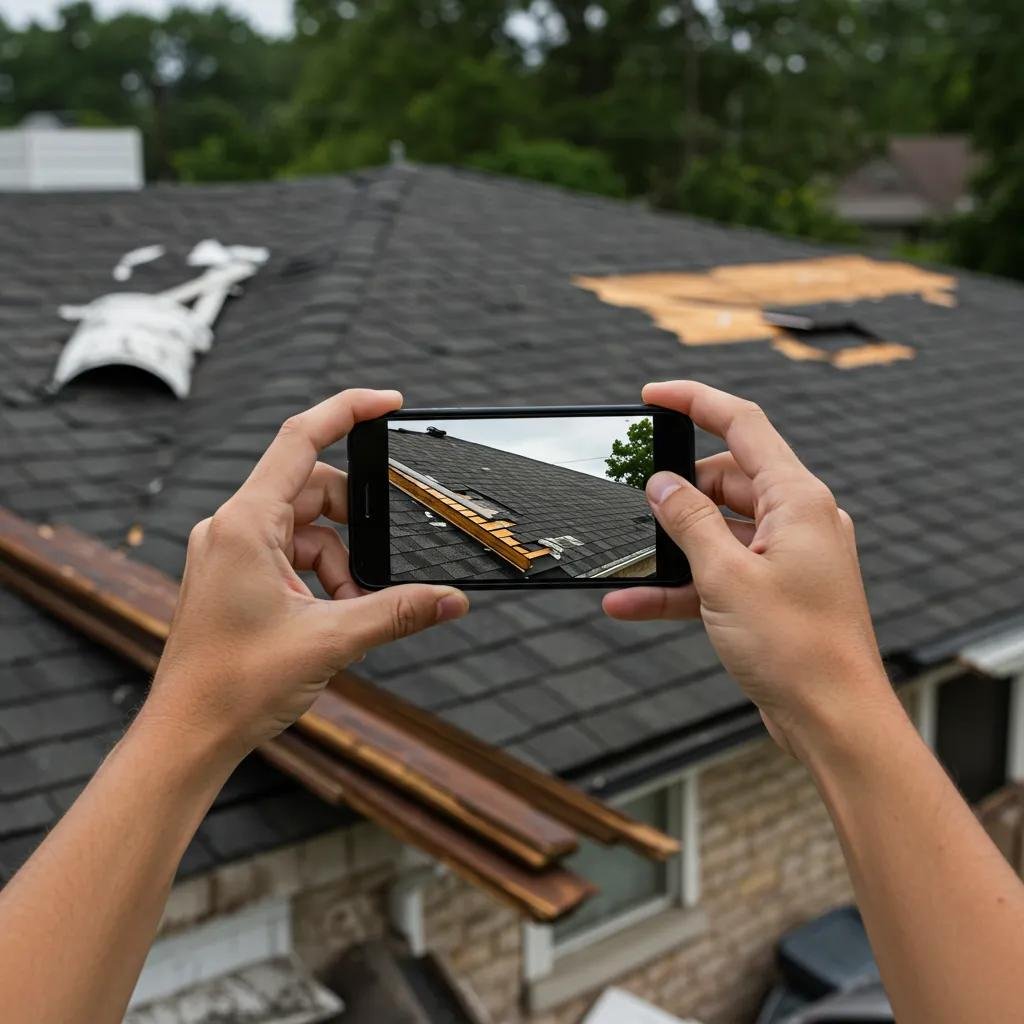

How Should You Document Roof Damage for Your Insurance Claim?

Thorough evidence collection includes:

- High-resolution photos of damage from multiple angles.

- Date-stamped videos capturing loose shingles and interior leaks.

- An inspection report from a licensed roofing contractor.

- Receipts for emergency repairs such as tarping services.

Comprehensive documentation clarifies the extent of loss, supports your settlement request, and minimizes disputes over damage scope.

What Is the Role of the Insurance Adjuster During Your Roof Claim?

An insurance adjuster evaluates damage severity and cost estimates, performing these tasks:

- Inspecting roof structure, underlayment, and interior ceilings.

- Verifying policy coverage, deductibles, and perils.

- Preparing an estimate for repair or replacement costs.

- Communicating findings and settlement offers to the homeowner.

Understanding the adjuster’s responsibilities helps you provide relevant information and advocate for full coverage under your policy terms.

When and Why Should You Hire a Public Adjuster for Your Roof Claim?

Hiring a licensed public adjuster benefits homeowners when:

- Claims involve complex storm damage or multiple perils.

- Insurance company estimates understate repair costs.

- The claim is denied or delayed beyond statutory deadlines.

- Policy language and exclusions require professional interpretation.

A public adjuster represents your interests, negotiates higher settlements, and expedites claim resolution while you focus on restoring your home.

What Are Common Reasons for Roof Insurance Claim Denials in Palm Beach County?

Insurers deny roof claims for coverage disputes, documentation gaps, or policy exclusions. Recognizing denial causes positions you for successful appeals and alternative remedies.

How Can You Identify If Your Roof Claim Has Been Wrongly Denied?

Signs of improper denial include:

- Citing wear-and-tear exclusions for sudden storm damage.

- Inconsistent inspection findings compared to contractor reports.

- Misapplication of roof-age rules without supporting evidence.

- Missing deadlines cited when documentation was submitted on time.

Detecting these errors early allows you to gather contradicting evidence and seek formal reconsideration or escalate the appeal process.

What Are Your Legal Options and Strategies for Appealing a Denied Roof Claim?

To challenge a denial:

- Submit a written demand letter outlining factual discrepancies.

- Provide supplemental documentation such as expert reports.

- Invoke Florida Statute 627.70132 to reopen or supplement your claim within legal timeframes.

- Engage a public adjuster or attorney experienced in insurance law.

Structured appeals combined with professional advocacy increase the likelihood of overturning denials and securing fair compensation.

How Do Recent Florida Legislative Changes Affect Denied Roof Claims?

Key reforms shaping appeals:

- SB 2-A (2023) restricts frivolous lawsuits by requiring presuit notice and architect’s seal for major damage claims.

- 627.70132 Deadlines mandate initial claim notice within one year and supplemental claims within 18 months of loss.

- AOB reforms limit assignment agreements and reduce excessive litigation.

Adhering to updated procedural requirements prevents forfeiture of rights and streamlines claim resolution under current statutes.

How to Find and Work with Reputable Roof Repair Contractors in Palm Beach County?

Selecting a qualified roofing contractor ensures code-compliant repairs and smooth insurer collaboration. Verify credentials and understand legal changes affecting contractor agreements.

What Licensing and Insurance Should You Verify in Palm Beach County Roofers?

Ensure contractors hold:

- A valid Florida Certified Roofing Contractor license.

- General liability insurance covering property damage.

- Workers’ compensation insurance for on-site personnel.

- Local business tax receipt and approved building department registration.

Confirming credentials reduces liability risk, assures workmanship standards, and aligns repairs with insurer expectations.

How Have Assignment of Benefits (AOB) Law Changes Impacted Contractor-Insurance Relationships?

Recent AOB restrictions:

- Prohibit contractors from unilaterally assigning claims without homeowner consent.

- Require clear disclosure of fees and legal rights before assignment.

- Limit contractor-initiated lawsuits to discourage inflated billing.

Understanding AOB reforms fosters transparent agreements and prevents claim delays due to contractual disputes.

What Emergency Roof Repair Options Are Available While Your Insurance Claim Is Processed?

Temporary solutions include:

- Professional tarping to prevent water intrusion.

- Boarding over exposed attic openings.

- Installation of drip edge or flashing to divert rainwater.

- Emergency sealants applied to visible leaks.

Implementing these measures protects interior structures, satisfies insurer’s mitigation requirements, and preserves claim integrity until full repairs commence.

What Local Resources and Regulations Affect Roof Repairs and Insurance Claims in Palm Beach County?

Palm Beach County enforces building codes, permit processes, and consumer protections that shape roof repair projects and insurer interactions.

What Are Palm Beach County Building Permit Requirements for Roof Repairs?

Permits are required for:

- Complete reroofs and replacement of sheathing.

- Structural modifications including decking or truss work.

- Changes to roof configuration or materials for waterproofing.

Permit applications must include contractor license details, construction plans, and fees. Securing proper permits ensures compliance with wind-load standards and avoids costly fines or insurance coverage disputes.

Which Consumer Protection Agencies Support Homeowners with Roofing and Insurance Issues?

Homeowners can seek assistance from:

- Florida Department of Financial Services’ Division of Consumer Services.

- Palm Beach County Consumer Affairs Division for contractor complaints.

- Office of the Attorney General’s insurance fraud unit for suspicious practices.

- Local legal aid clinics offering guidance on appeals and bad faith claims.

Accessing these agencies helps resolve disputes, report unlicensed contractors, and enforce fair claim practices.

How Can Palm Beach County Disaster Preparedness Resources Help with Roof Damage Recovery?

Preparedness tools include:

- County’s hurricane season readiness guides.

- Community emergency response team training for post-storm assessments.

- Dedicated shelters and building material distribution centers.

- Flood zone and wind-mitigation rebate information from the county’s resilience office.

Leveraging these resources enhances safety planning, reduces recovery costs, and aligns restoration efforts with county disaster-resilience programs.

How Long Does the Roof Insurance Claim Process Take in Palm Beach County?

Understanding statutory deadlines and average inspection timelines sets realistic expectations and prevents delays that could jeopardize coverage.

What Are Typical Timeframes for Filing and Supplemental Claims Under Florida Statute 627.70132?

Statutory deadlines include:

- Notice of initial loss or damage within one year of the incident.

- Supplemental or reopened claim submission within 18 months after the date of loss.

- Insurer response to supplemental claims within 30 days of receipt.

Meeting these deadlines preserves your right to full compensation and avoids claim forfeiture due to procedural lapses.

How Long Does Insurance Adjuster Inspection and Claim Settlement Usually Take?

Average timelines:

- Inspection scheduling: 7–14 days after claim filing.

- Adjuster evaluation: 1–2 hours on site.

- Estimate delivery: Within 7 days of inspection.

- Settlement processing: 14–30 days after estimate approval.

Timely communication and complete documentation accelerate adjuster visits and minimize back-and-forth on payouts.

What Factors Can Delay or Expedite Your Roof Insurance Claim?

Key influences include:

- Complexity of damage and scope of repairs needed.

- Completeness of documentation and photographs submitted.

- Seasonal storm volume affecting adjuster availability.

- Clear permit and contractor information provided to your insurer.

- Prompt mitigation measures and public adjuster involvement.

Proactive steps and professional support reduce bottlenecks and expedite settlement disbursement.

How Can You Maximize Your Roof Insurance Payout in Palm Beach County?

Optimizing claim value relies on thorough evidence, strategic policy selection, and skilled advocacy to ensure you receive full entitled benefits.

What Documentation and Evidence Strengthen Your Roof Damage Claim?

Essential materials:

- Before-and-after photographs dated and geotagged.

- Licensed contractor estimates itemizing labor, materials, and debris removal.

- Weather reports confirming storm events on damage dates.

- Maintenance records demonstrating proactive roof care.

A robust evidence package substantiates damage causation, reinforces coverage eligibility, and prevents undervaluation.

How Does Hiring a Public Adjuster Help Increase Your Claim Settlement?

A public adjuster provides:

- Expert interpretation of policy language to identify all covered perils.

- Detailed estimate preparation reflecting accurate repair costs.

- Negotiation tactics that counter insurer lowball offers.

- Assistance with supplemental claims when hidden damage emerges.

Aligning with this advocate often yields settlements 20–30% higher than insurer initial offers, maximizing your payout.

What Are the Differences Between Actual Cash Value and Replacement Cost in Maximizing Payouts?

Understanding the difference between ACV and RCV is fundamental to maximizing your insurance payout.

MATH OR MYTH: CALCULATING ACTUAL CASH AND REPLACEMENT COST VALUES

… the replacement costs of individual components, such as roofing materials …MATH OR MYTH: CALCULATING ACTUAL CASH AND REPLACEMENT COST VALUES, Unknown Author, 2018

| Value Basis | Coverage Extent | Homeowner Benefit |

|---|---|---|

| Actual Cash Value (ACV) | Payment after depreciation | Lower initial payout but lower premiums |

| Replacement Cost Value (RCV) | Full cost without depreciation | Higher upfront payout for new materials |

Choosing RCV policies and documenting roof condition prevents depreciation deductions, ensuring full restoration with minimal expense.

What Are the Latest Trends and Statistics Affecting Roof Insurance Claims in Palm Beach County?

Tracking market shifts, storm impacts, premium fluctuations, and legislative reforms helps homeowners anticipate claim challenges and opportunities.

How Have Recent Hurricanes and Storms Impacted Roof Damage Claims in Palm Beach County?

Major storm data:

- Hurricane Michael (2018) drove a 35% spike in roof claims.

- Intense hailstorms in early 2025 caused over 1,200 individual claims.

- Seasonal thunderstorms contribute to 40% of minor roof damage incidents.

Increased storm frequency underscores the importance of updated policies and rapid damage mitigation to secure timely settlements.

What Are Current Florida Homeowners Insurance Premium Trends and Their Impact on Roof Claims?

Recent premium shifts:

- Average annual premium approaching $11,000 in coastal counties.

- Insurers offering discounts for impact-resistant shingles and mitigation features.

- Risk-based pricing models adjusting rates according to individual roof age and wind-mitigation credits.

Rising costs incentivize homeowners to invest in fortified roofing systems and detailed claim documentation to avoid premium surcharges after filing.

How Are Legislative Reforms Stabilizing the Florida Property Insurance Market?

Policy changes driving market balance:

- Assignment of Benefits limits curtail lawsuit filings by contractors.

- New insurer licensing standards attract additional carriers, increasing competition.

- Revised rate-filing regulations encourage moderate premium increases aligned with actuarial data.

These reforms promote claim transparency, reduce litigation costs, and gradually stabilize coverage availability and affordability.

Roof insurance claims in Palm Beach County demand precise understanding of coverage perils, policy valuations, and state regulations. By following structured documentation processes, leveraging local resources, and engaging professional advocates, homeowners can streamline claim approvals and secure fair settlements. Proactive compliance with permit requirements, AOB reforms, and appeal procedures further protects your rights under Florida statutes. Equipped with these insights, you’ll confidently manage roof repairs and insurance interactions, ensuring your home remains safeguarded against future storm events.